The week in Italian startups - Issue #42

The Money

Scalapay, a Milan-based buy-now-pay-later startup, raised €40m from Fasanara Capital, Baleen Capital, and Ithaca Investments.

Enthera Capital, a biotech company, extended its Series A to €35m. The Roche Venture Fund joined Sofinnova Partners, AbbVie Ventures, and others that invested the first €28m in July 2020.

Crea Assicurazioni, an insurtech company, 🇮🇹raised €2m from Step (a retail service company), CDP Venture Capital, and Digital Magics.

Speaking of Digital Magics: 🇮🇹 the incubator announced another round of investments in 8 of its portfolio companies. CDP Venture Capital led the investments with its "AccelerOra" fund, dedicated to startup accelerators.

Dynamopet, a producer of integrators for pets, 🇮🇹raised €500k from a syndicate of investors.

Invitalia, the Italian state agency for enterprise development, invested €81m in ReiThera, a biotech company developing a COVID-19 vaccine.

Genuino, a blockchain technology startup, 🇮🇹 announced on Linkedin a seed round led by CDP Venture Capital. Amount undisclosed.

M&A

CDP invests in October

October is a French crowdlending service for business loans: it offers a platform for private and professional investors to participate in direct loans to SMEs based in France, Spain, the Netherlands, and Italy. Each loan is funded in part by October-run funds and in part by private lenders.

CDP joined EIF, BPIFrance, and the Spanish Official Credit Institute in funding October SME IV, the fourth pan-European private debt fund created by October and aimed at SMEs. CDP committed €20m, destined to Italian enterprises.

Daje!

The promise of delivering anything you want, as soon as possible, anywhere you are, has been associated with the Internet almost since its inception. (In)famous tentatives to deliver on this promise date back to the first Internet boom in the late '90s: startups such as Kozmo and Urbanfetch tried and failed, burning millions of dollars in a blink.

Today, more than 20 years later, the market has matured. Internet and credit card payments are commonplace, and the promise is finally working: it is easy for consumers to buy almost anything online and have it delivered in a few hours or a few days.

The pandemic acted as a great catalyst to the diffusion of these services: online delivery supported the locked-down families during 2020 as shops were closed.

In a reversal that took only a couple of decades to materialize, the lack of an online channel is putting mom-and-pops businesses at risk of being strangled by online services that are finally proving their worth.

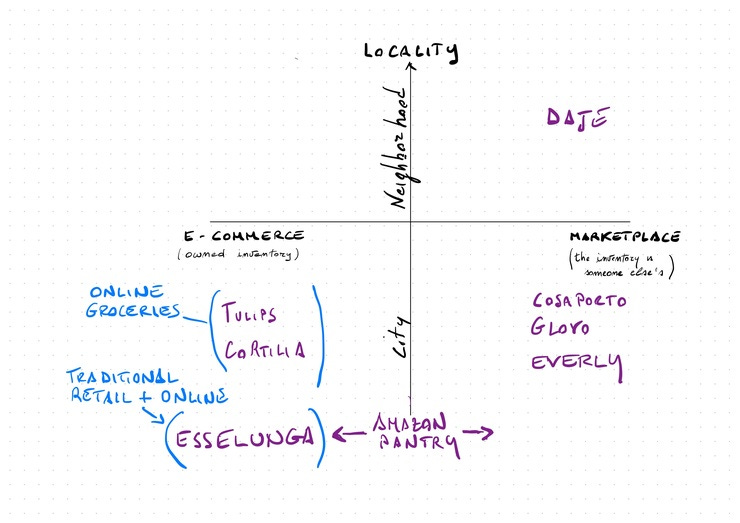

Unless, of course, a new wave of startups manages to create a sustainable business with local retailers, taking the idea of "delivery platforms" one step further, to the neighborhood level.

Nicola Mattina published an article about his experiment with Daje!, a proximity e-commerce startup based in Rome. Daje is still in its early stages, but the article contains some interesting "hands-on" ideas about market testing and MVP development.

As I was reading the article, I started thinking about how e-grocery shopping is currently evolving in Italy and jotted down the chart below (not exhaustive!). The market is moving fast and as new startups are entering the proximity market, incumbent delivery platforms are setting up their own dark stores to leverage their current position.

That's it for issue #42. 🐳🪴

Have a great week,

N.