The week in Italian startups - Issue #46

The Money

CDP Venture Capital announced several investments:🇮🇹€400k in Offlunch (with LVenture and business angels); 🇮🇹€445k in Confirmo (with LVenture and business angels); 🇮🇹€485k in BeSafeRate (with LVenture and business angels); 🇮🇹€450k in Competitoor (with Primomiglio and business angels - the company also announced the acquisition of Ragtrades, an American competitor).

Arisk, an AI startup developing risk prediction models, 🇮🇹 raised €700k in an angel round.

Sellrapido, an eCommerce automation startup, 🇮🇹raised an unknown amount from Azimut Digitech Fund (its first investment since inception) and Gellify.

M&A / IPO news

Antares Vision [AV.MI] entered into an agreement for the acquisition of rfXcel Corporation for a total consideration of $120m on a cash-free/debt-free basis.

Leonardo [BIT: LDO], a defense and aerospace company, filed an S-1 registration statement with the SEC to list a minority stake of its DRS subsidiary.

TeamSystem 🇪🇸acquired Billin, an invoicing startup from Spain, for an undisclosed amount.

2020 in Italian VC

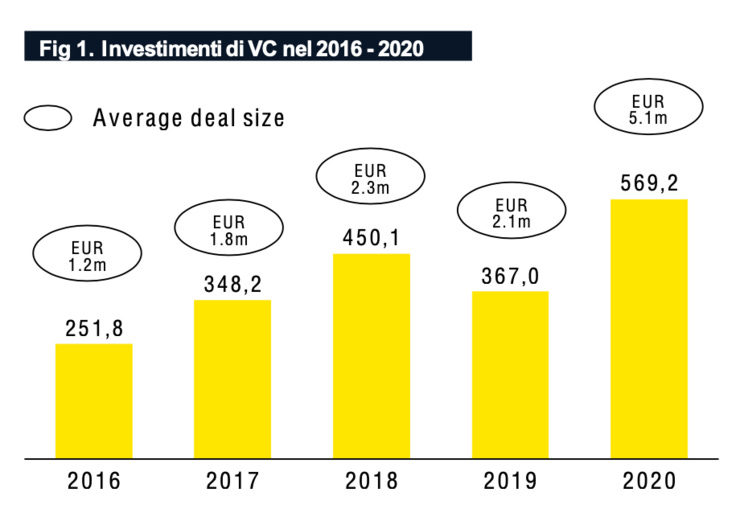

The 🇮🇹 EY VC Barometer 2020 and the 🇮🇹 Venture Capital Monitor 2020 were both released last week. The studies make a similar photograph of the Italian ecosystem: still small and young with respect to its peers (less than €600m raised from Italian startups) but growing and beginning to attract interest from foreign investors.

An interview with Francesco Inguscio

Francesco is a friend, an entrepreneur, and one of the most active catalysts of the Italian startup ecosystem. He was interviewed by Ilaria Cavalleri on her blog, talking about "Haters gonna pay" (his latest startup with a strong social mission) and Rainmakers, his venture studio.

EIF Market Survey

The European Investment Fund published a market sentiment paper comparing results from its VC, PE, and angels market surveys, dating back to October 2020. The presentation is 108 pages long and contains some interesting insights, such as:

VC and PE MM respondents are optimistic regarding the current state of business and expectations for the next 12 months.

Fewer VC respondents are negatively impacted by the COVID-19 crisis and a significantly higher percentage is positively impacted.

The vast majority of VC and PE MM fund managers were already considering ESG issues, and the crisis reinforced the need to do so.

The surveys showed that the main concerns are the exit environment and the access to finance of portfolio companies.

Ending notes

This is it for this issue. Take care and remember to share your feedback or news that I missed.

✌🏻

N.