The week in Italian startups - Issue #49

The Money

Casavo, a real estate instant buyer, raised €200m in an equity+debt deal led by Exor Seed.

Contents.com, an AI-driven content creation startup, 🇮🇹 raised €5m in a round led by Sinergia Venture Fund.

Ricehouse, a sustainable architecture startup producing rice-based plaster, 🇮🇹 raised €600k in a syndicated round with the participation of B-Heroes, AImpact, Impact Hub, and others.

New York-based fitness startup Xtra 🇮🇹 raised €600k in a pre-seed round.

Reviva, a prop-tech startup that "peps up" foreclosure auctions, 🇮🇹 raised €250k in an angel round.

Mogu, a product design startup, raised €1.1m in a round led by Progress Tech Transfer fund.

LIFTT, a Turin-based investment vehicle, announced a €4m capital increase to continue its investment program.

IPOs & M&A

Last February, micro-mobility company Helbiz announced it would go public in Q2 by merging with GreenVision Acquisition Corp, a SPAC listed on the NASDAQ, at a valuation of $408m. Last week, the company confirmed it would also receive a $30m private investment in public equity (PIPE) in additional capital. In case you are curious, you can download the pitch of the business combination. Helbiz reports $4m in revenues for 2020, with a strong market presence in Italy.

Digitouch [DGT.MI], a digital transformation company, 🇮🇹 announced the acquisition of Ondeal, a startup running the 4deal marketplace hub. Digitouch will pay a total of €1.2m for the deal.

Reevo, a Milan-based provider of secure cloud solutions, 🇮🇹 filed with Borsa Italiana for an IPO, to be completed in April. The IPO is priced in the range of €7.48-8 per share, valuing the company between €29m and €31m. The announcement 🇮🇹reports gross sales for €9.3m in 2020 and a 19.4% EBITDA margin.

The Italian Martech landscape

Vincenzo Cosenza published on his blog the 🇮🇹 landscape of Italian Martech startups, a collection of ~100 startups operating in the market. Fewer than I expected, to be honest.

IAG Index

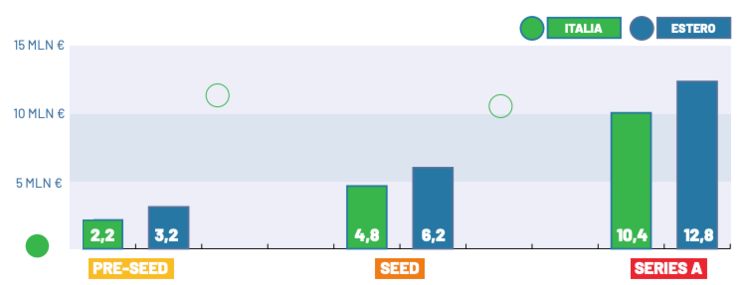

Italian Angels for Growth is one of the largest and most active angel clubs in Italy. Last week, it published its IAG Index, an analysis of their deal-flow. An infographic showing the main results is 🇮🇹 available from here. One of the notable observations emerging from the analysis is the difference in average pre-money valuation between Italian and foreign companies, showing a 20% gap.

Ending notes

I received a few requests to add some features to the newsletter - e.g. a job section for startups looking for talent. I'm up for experimenting: if you run a startup, have open job positions, and think this might work, send me a note (i.e. reply to this email) and help me put together something useful.

Have a great week and stay safe,

N.