The Week In Italian Startups - Issue #134

Planet Farms, Eggtronic, Fiscozen, Kippy, and others raised funding. New funds from P101 and CDP. Eligo went public. Oh, and happy new year, everyone! 🤩🥳

Hello,

This is Niccolò from Primo Ventures. Every week I publish what’s going on in the Italian startup ecosystem.

New year, new platform: after Revue’s demise, I moved to Substack. I will experiment a bit: content, structure, look&feel may change in the coming weeks, so bear with me.

Now on with the news from the last couple of weeks: 2022 ended with a bunch of interesting rounds, a small IPO, and a couple of new funds announced. The year was the best so far for Italian startups in terms of fundraising (exits, not yet), but don’t forget that we still have a long way to go before entering the same league as our European peers.

Let’s see if this year we can do better! 💪🏻

Happy new year to all of you!

The Money

Planet Farms, a vertical farming startup, 🇮🇹raised a €17.5m loan facility from Unicredit to build a new indoor farm.

Eggtronic, a hardware startup, raised $12m in a series B round led by Rinkelberg Capital, with the participation of CDP VC and Doorway. The startup aims at raising $20m.

Fiscozen, a provider of an accounting software platform for freelancers, raised €8m in a series A round led by Keen Venture Partners and followed by United Ventures, already an investor.

Kippy, an IoT-enabled petcare company, 🇮🇹raised €2.6m from Oltre Impact.

Frankly Bubble, a bubble tea store chain, 🇮🇹raised €2.5m from CDP VC Fondo Rilancio.

Matix, an IoT-based digital transformation startup, 🇮🇹raised €0.7m from Auxiell and a bunch of business angels.

Relicta, a bio-plastics startup, 🇮🇹raised €0.5m in a round led by Scientifica VC.

IAG invested in Neurobrave, an Israeli mental wellness startup.

New Funds

P101 announced the first closing at €150m of P103, its newest fund.

SIMEST and CDP VC 🇮🇹joined forces. The former will commit €50m in direct co-investments with the latter; an additional €150m from SIMEST will be managed by CDP in a new fund aimed at attracting international investors to Italy.

Intesa San Paolo and Digital Magics announced a joint venture to invest €15m in fintech / insuretech / proptech startups, with an average ticket of €250k.

M&A

YOLO 🇮🇹announced the acquisition of 51% of AllianceInsay Broker Spa, an insurance broker, for €1.1m.

IPO

Eligo, an e-commerce startup, went public on the Euronext Growth Milan, in the professional segment. The startup had a market cap at IPO of €13.9m.

Reading during the holidays

78 new startups from the EU were accepted into the EIC Accelerator. Congrats to the 5 Italian companies selected for the program!

Bank of Italy 🇮🇹is worried about BNPL.

Unicredit was among the investors in the latest round raised by Casavo, announced back in July. Curious about why they announced it now 🤔.

Fundraising tracker

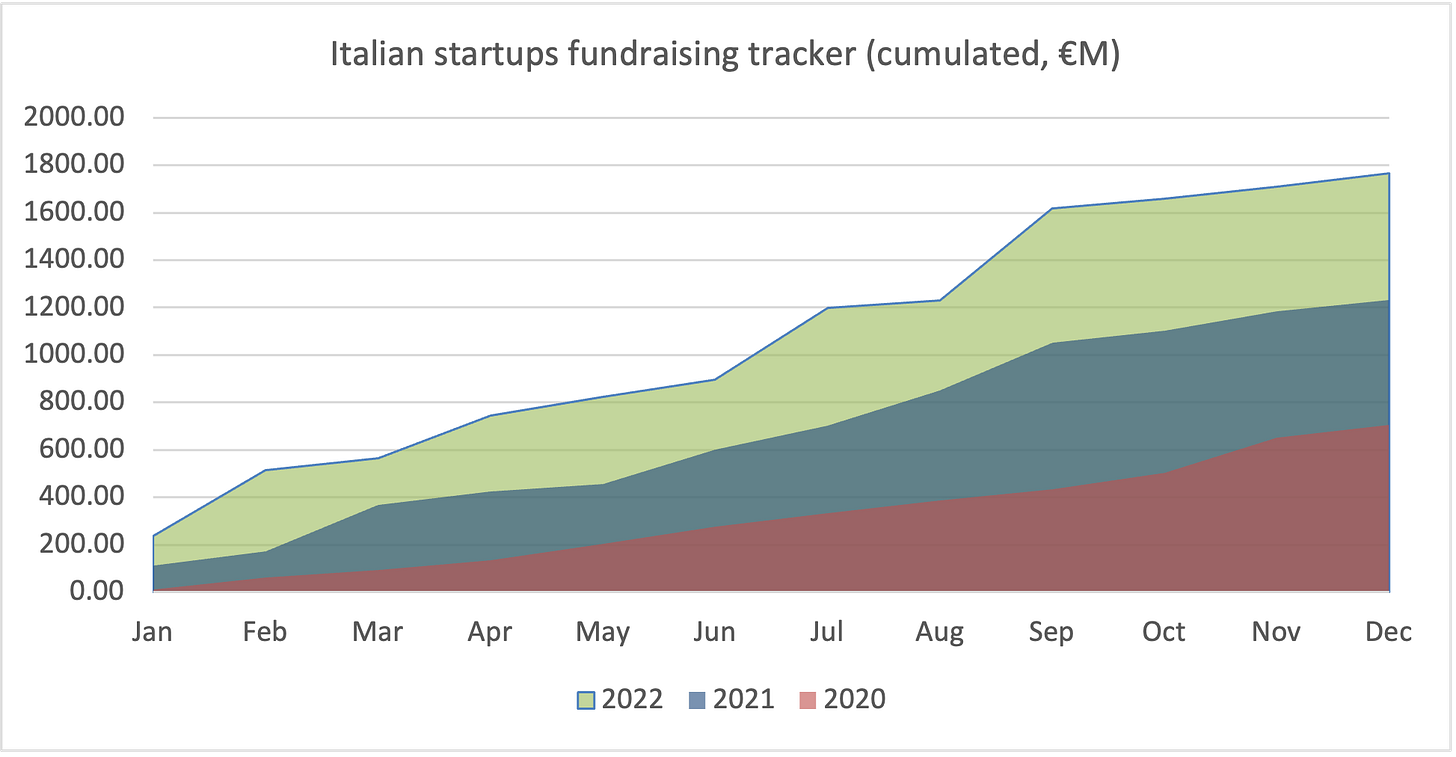

This fundraising tracker is updated weekly based on the news published in this newsletter. Excluding pure debt investments, equity and quasi-equity rounds touched €1.8b.

Ending Notes

The newsletter runs on a brand new platform, but Giacomo Mollo and I will continue commenting on the latest news every week: subscribe to our podcast on YouTube, Spotify, Apple Podcast, and other platforms to get additional insights on what is happening in the Italian ecosystem.

Have a great 2023,

N.

Ottima mossa passare a Substack, così potrò anche consigliarvi ai miei iscritti! Benvenuti