TWIS #153

Bending Spoon raised more debt. Viceversa and others raised funding. Moonstone, a new pre-seed fund.

Hello,

Welcome back to The Week in Italian Startups. This is Niccolò from Primo Ventures: every week, I publish my curated list of the latest news from the Italian startup ecosystem.

The Money

Bending Spoons 🇮🇹raised a €70m debt facility from SACE and Intesa Sanpaolo.

Viceversa, a revenue-based financing startup, raised €10m in a round led by CDP VC.

Primo Space 🇮🇹announced an undisclosed investment in Lulav Space, an Israeli space tech startup.

ALICE, Beyond CrioPurA, e-CO2Synt, and IliCO2Sep 🇮🇹raised €1m in funding from Eureka! Ventures.

Clearbox AI, a synthetic data startup, raised €385k in a seed round.

Startup Geeks, an edutech platform for entrepreneurs, 🇮🇹raised funding from Seed Money.

Prometheus, a medtech startup, 🇮🇹raised €2.7m in a crowdfunding campaign. Fintech Partners invested €0.5m in the campaign.

MyNet, a productivity startup, 🇮🇹raised funding from Credemtel.

Fasanara 🇮🇹acquired 10% of CashInvoice, a B2B BNPL startup.

Adams Biotech 🇮🇹raised a €470k loan facility.

Club degli Investitori 🇮🇹invested in Largix, an Israeli 3D printing startup.

New funds

Italian Angels for Growth and Catalyst Investors Club 🇮🇹announced Catalyst Crowd, a new crowdinvesting platform for European startups.

Moonstone, a new micro VC with the goal to invest up to €50k in 60 startups in two years, was 🇮🇹launched.

Rewind

A fun story about the hype around generative AI: rewind.ai is a startup founded by Dan Siroker (founder of Optimizely).

Siroker decided to go public with his investor pitch (great performance, tbh).

In the end, he received more than 1,000 soft proposals, he turned down offers valuing Rewind >$1bn, and accepted $12m at a $350m premoney by NEA. 🤯

Peak Generative AI?

Reading this week

Azimut 🇮🇹announced Automobile Heritage Enhancement, a fund investing in classic cars.

Doorway and Seedblink 🇮🇹joined forces to share dealflow to their investor networks .

A 🇮🇹research on Italian VC by the School of Management of the Polytechnic of Milan, alongside other business schools in EU, shows that VC in Italy are slightly

lessmore risk averse than US or European ones.PWC published a research on the economic impact of PE and VC in Italy.

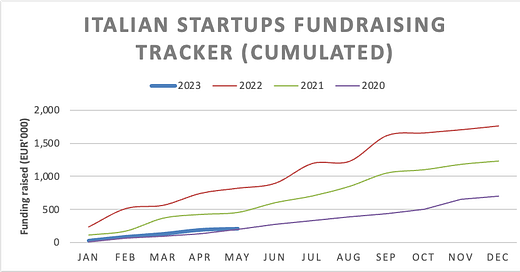

Fundraising Tracker

Ending Notes

Giacomo Mollo and I comment weekly on the latest news: subscribe to our podcast on YouTube, Spotify, Apple Podcast, 🔥Amazon Music🔥, and other platforms to get additional insights on what is happening in the Italian ecosystem.

Have a great week,

N.