TWIS #265

NanoPhoria, Lexroom, Serenis, and AndromedAI raised funding. A2A launched A2A Life Ventures. Lucio Rovati is Club degli Investitori's Business Angel of the year. The State of VC in Italy 2025.

Hello,

Welcome back to The Week in Italian Startups. This is Niccolò from Primo Capital: every week, I publish my curated list of the latest news from the Italian startup ecosystem.

The Money 💰

NanoPhoria 🇮🇹raised €81m in a Early-stage round from XGen Venture sgr, Cassa Depositi e Prestiti, Panakes Partner sgr, Sofinnova Telethon Sca, Sofinnova Partners, and Cdp Venture Capital.

Lexroom raised €16m in a Series A round from Base10 Partners, Acurio Ventures, View Different, Entourage, Verve Ventures, and Joe Zadeh.

Serenis 🇮🇹raised €12m in a Series A round from Angelini Ventures, CDP Venture Capital, Azimut Libera Impresa, X-Equity Venture Club Srl, Invictus Capital, Lumen Ventures, FG2 Capital, Club degli Investitori, and Doorway.

AndromedAI raised €1.1m in a Seed round from The TechShop

, CDP Venture Capital’s Digital Transition Fund, Club degli Investitori, and Nana Bianca.

The Money - Italians abroad 🌎

Lupa raised €20m in a Series A round from Singular, Firstminute Capital, and Michael Callahan.

Reading this week📚

A2A 🇮🇹announced A2A Life Ventures, a newco consolidating all their open innovation initiatives.

Ventive 🇮🇹raised €10m to continue investing and supporting Italian startups.

Lucio Rovati 🇮🇹was named best Italian Business Angel by Club degli Investitori. Kudos to Giuseppe Lacerenza (best international BA of the year) and Marco Nannini (best impact BA of the year).

Yahoo nears deal to sell AOL to Italy’s Bending Spoons for $1.4 billion, sources say | Reuters.

Vado is 🇮🇹expanding to London, Wien, and Zurich.

Milan’s Domyn eyes €1B raise to build Europe’s AI gigafactories | TFN.

Making the Physical World Programmable | Simone di Somma.

Optimizing for AI Mode Guide | WordLift.

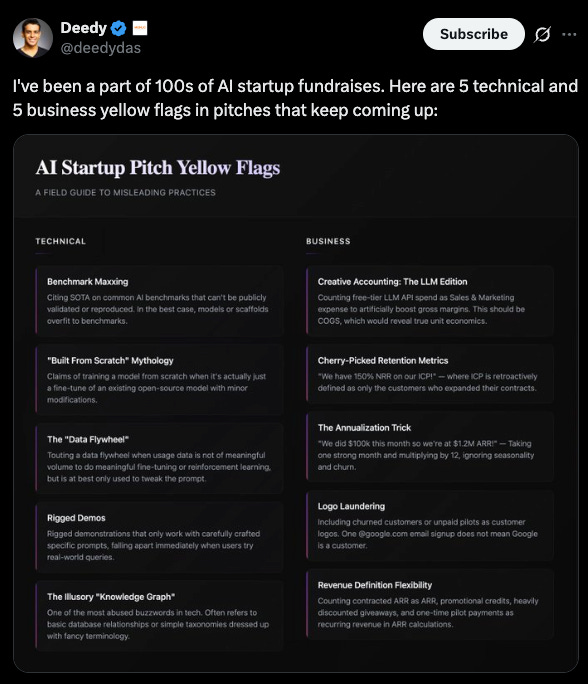

AI Startup Pitch Yellow Flags:

The State of VC in Italy 2025🇮🇹

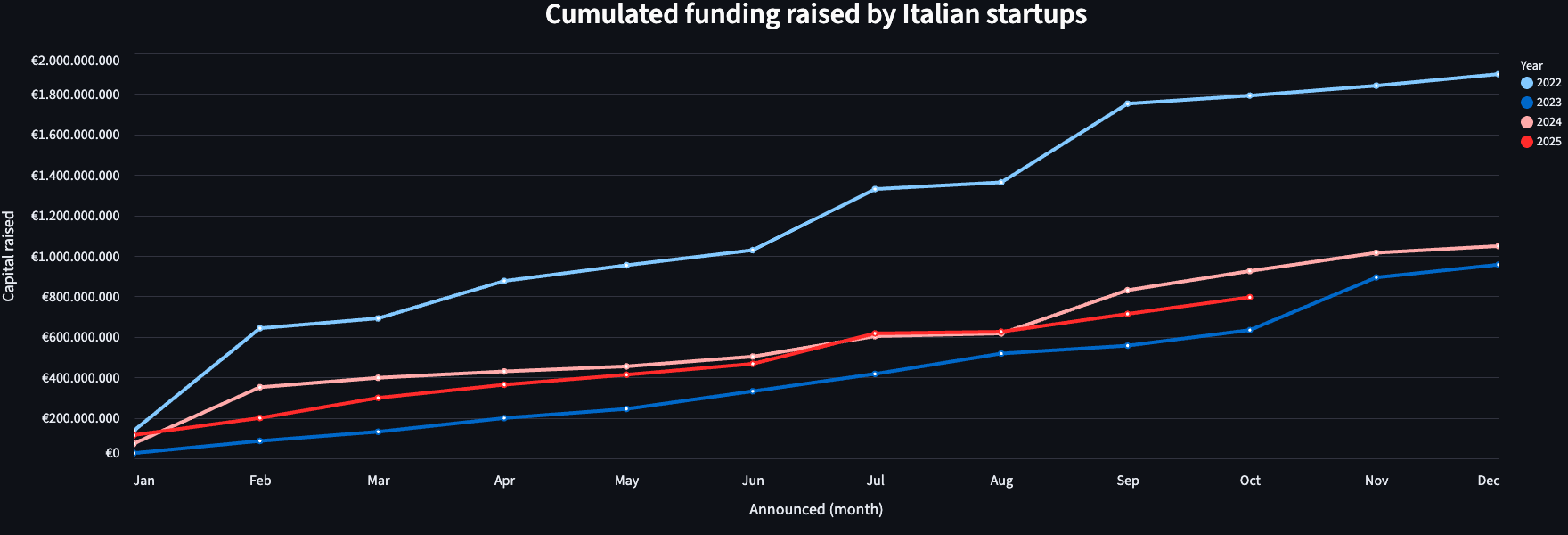

During Italian Tech Week, Yoram Wijngaarde presented Dealroom’s latest State of VC in Italy 2025, a 25-slides recap of what’s going on in the Italian VC ecosystem. The slides are packed with great insights, but let me elaborate a bit on the four that stood out to me:

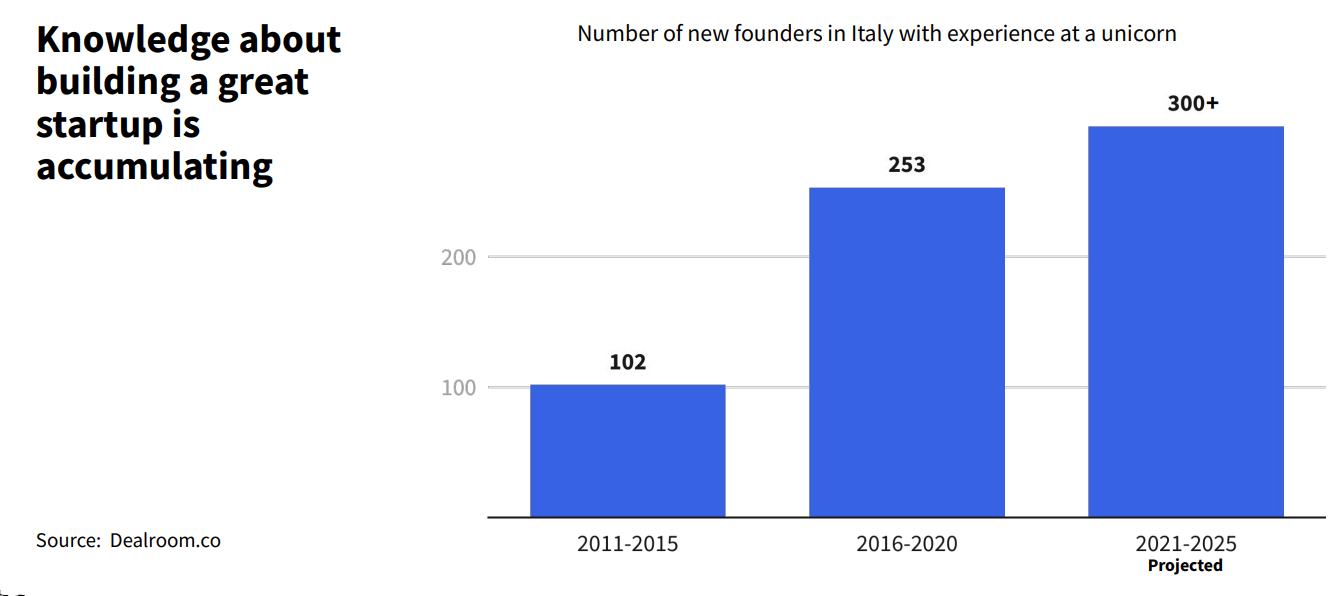

More and more Italian founders have had previous exposure to unicorn startups:

Why is this important? I believe humans are mimetic - and being exposed to how things have been done in other contexts can greatly accelerate their efforts in other contexts.

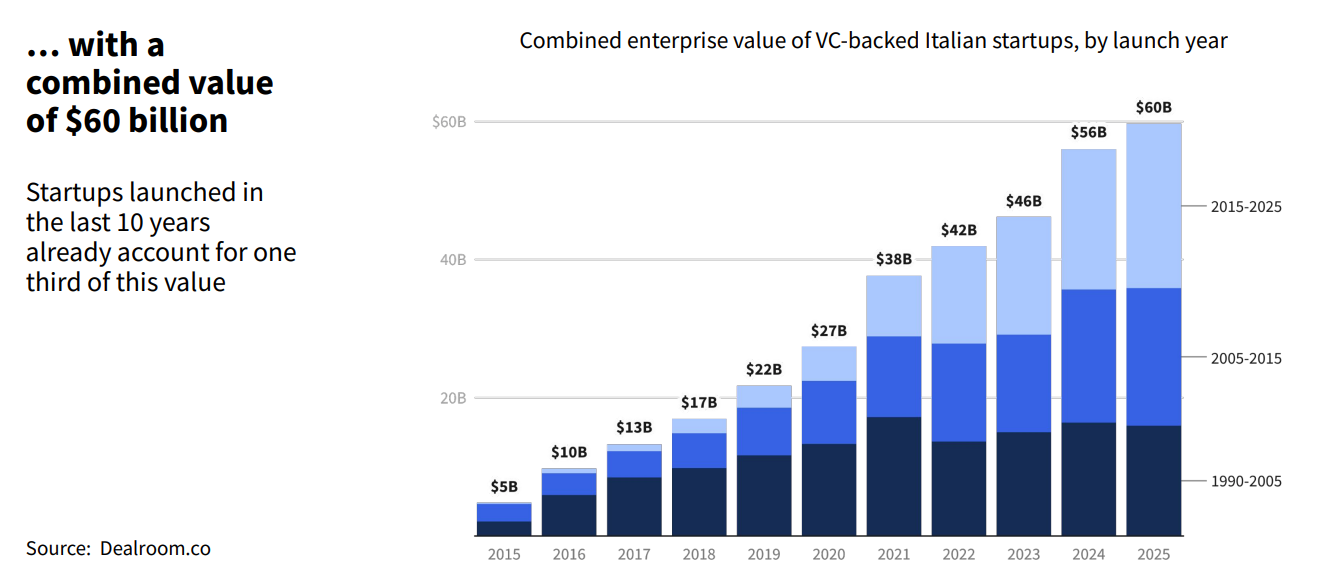

The combined EV of Italian startups grew by €14Bn in 2 years:

Why is this important? This number at first hit me as bollocks. How can it be that €2bn in additional private capital in 2 years unlocked more than €14bn of value? Then you look at the details and two observations emerge: [1] the increase in 2025 appears to be mostly in younger startups (€1bn invested → +€4Bn value unlocked, not unreasonable). [2] Most of the growth unlocked in 2024 appears to come from some startup(s) founded the 2005-2015 decade. I wonder which one that is?

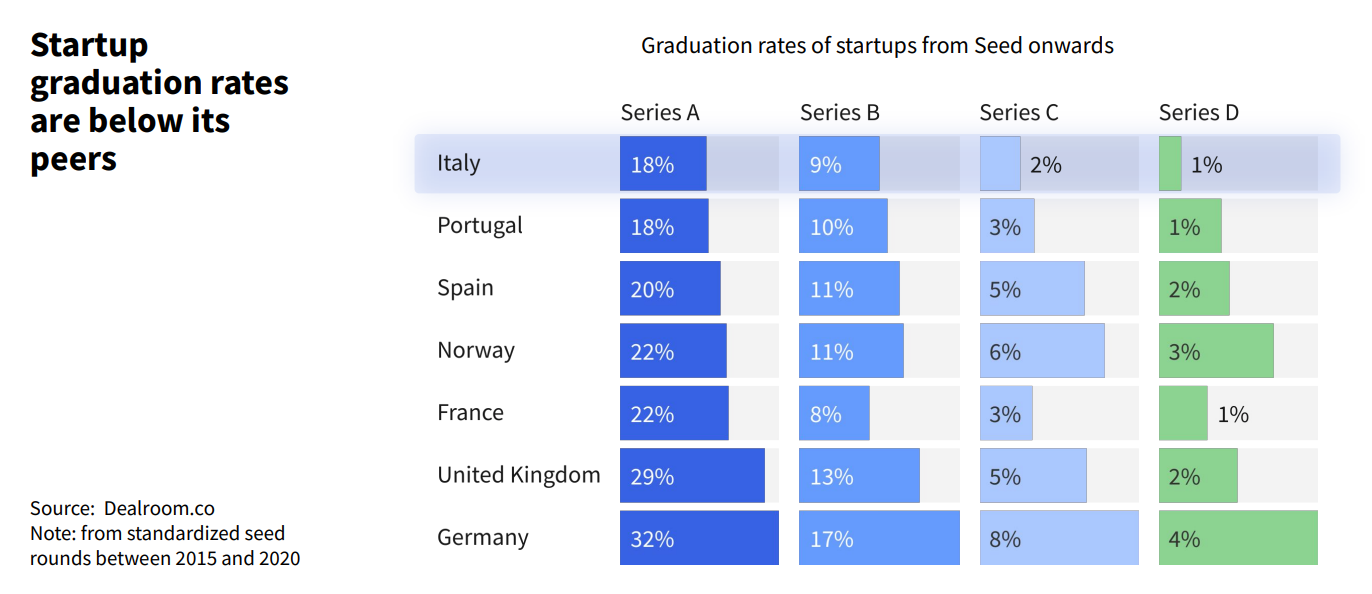

Graduating rate across stages is painful to look at:

Why is this important? VC is a game that only works when you get to true scale - and this means raising C/D rounds. Italy is the worst performer in the Series C stage - and this is no good news for Italian VC funds in the 2010-2020 vintage. (note: I don’t get why the 1% value in the Series D column has different lengths for different countries 🤨).

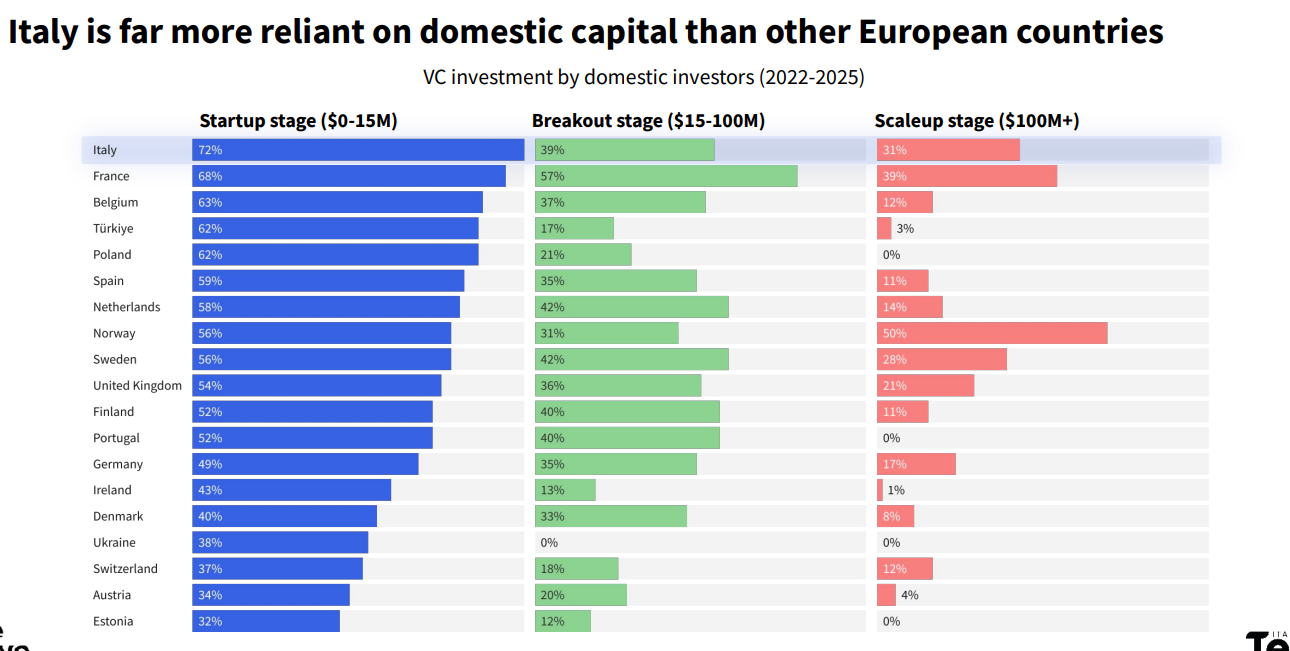

Italian startups are still relying heavily on domestic funds to start - but my perception is that this is changing fast.

Why is this important? I am curious about looking back at this chart in a couple of years time. Since the ecosystem of Italian VCs is not that broad, I expect to witness som change, assuming our founders will become even more competitive on the international stage (which I have little doubt about).

🌟Jobs in Italian Startups🌟

If you want to share or more job positions relevant to the Italian ecosystem, fill out this form. Looking for a new job? Check out this link!

Startup Events in Italy🎪

Keep an eye on the upcoming events in the Italian ecosystem. Feel free to add an event through this form.

Latest events:

Fundraising Tracker 📈

Ending Notes📝

Don’t forget to check out the TWIS dashboard for the latest updates.

If you want to know more about sponsoring TWIS (and/or the podcast episodes), read some info here and send me a note!

Giacomo Mollo and I comment weekly on the latest news: subscribe to our podcast on YouTube, Spotify, Apple Podcast, Amazon Music, and other platforms to get additional insights on what is happening in the Italian ecosystem.

Have a great week,

N.