TWIS #264

Tretau, Syllotips, Pillar, and TextYess raised funding. Teamsystem announced another acquisition. Bending Spoons valued €5bn. A comparison of VC across geographies.

Hello,

Welcome back to The Week in Italian Startups. This is Niccolò from Primo Capital: every week, I publish my curated list of the latest news from the Italian startup ecosystem.

The Money 💰

Tretau raised €20m in a Series C round from T2Y Capital, CDP Venture Capital, Finindus, MITO Tech Ventures, Syensqo Ventures, and Santander Alternative Investments.

SylloTips raised €4.2m in a Seed round from Azimut, The Techshop, Techstars, Cloud Accelerator, Leo Capital, and business angels.

Pillar raised €3.2m in a Pre-seed round from Emblem, Pareto, Plug and Play, Kima Ventures, B Heroes, Vento, Eden Ventures, IAG, Paola Bonomo, Ignazio Rocco Da Torrepadula, and Enrico Pandian.

TextYess 🇮🇹raised €2.4m in a Seed round from VC Partners, Entourage, Angel Invest Ventures, Filippo Conforti, David Clarke, Gianluca Cocco, Mattia Montepara, Michele Attisani, Federico Sargenti, Luca Rodella, Paolo Fois, Marco Castello, and Gabriele Tagliavia.

The Money - Italians abroad 🌎

Sartiq raised €2.1m in a Pre-seed round from Founderful, Venture Kick, and Magic Mind (Zest).

M&A 🥩

Teamsystem acquired Sellsy in France.

Young Platform and Fleap 🇮🇹joined forces.

Reading this week📚

TIP, a listed shareholder in Bending Spoons, 🇮🇹updated the value of its holding in the latter, valuing it €5bn.

Why should we invest in Space Domain Awareness? | Ecosmic / Primo Capital.

🇮🇹Zest closed H1 in the red, and is getting ready to raise capital | Bebeez.

🇮🇹A new foodtech incubator was launched in Verona | Startupitalia.

Andrew Ng at YC startup school on building startups with AI | YC.

Notes on origination | Creditstick.

Q2 2025 VC Fund Performance | Carta.

Comparing VC returns across geographies ✍🏻

Last week the European Investment Fund and Blackrock released TrackVC, a dashboard showing aggregate statistics around VC and PE performance in Europe. I (vibe)wrote a thread on X as soon as the portal was released:

More transparency is inherently good in any market. But numbers in a void do not help: how does European VC compare against other benchmarks? Luckily, AngelList recently released their State of Venture Report for H1 2025, aggregating data from funds running on their platform. Their report also included data from Cambridge Analytica for comparison.

Juicy!

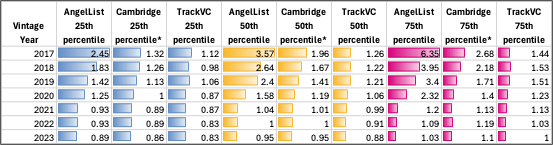

I could not resist and I pooled the data together1. Below you can find a side-by-side comparison among AngelList, Cambridge Analytica, and TrackVC for VC vintages 2017-2023. The reports share TVPI, IRR, and DPI, the state-of-the-art indicators of a fund performance.

In this case, two things to observe:

It hurts to see the difference in TVPI across all percentiles. TrackVC’s 75th percentile is lower than AngelList 25th percentile.

In TrackVC case, the difference between 25th and 75th percentiles is pretty tight.

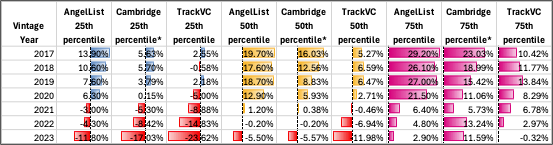

Next, IRR:

Nothing new to see here. It looks like the 75th percentile in AngelList and Cambridge are keeping the “VC returns” promise, but even the 50th percentile is not too shabby. Again, TrackVC data hurt: the 75th percentile does not look like it is meeting return expectations.

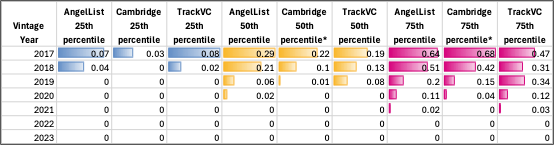

Finally, DPI:

Here we are talking real money: this is were the story becomes interesting, and differences flatten out. For the 2017 vintage we still see a visible difference across data sources, but not as huge as before. We also have instances of TrackVC data outperforming its counterparts.

I found these data super interesting. European VCs were thought to play in a minor league than their US counterparts, but when you get to actual money the differences become much less evident. I can formulate a few hypotheses about the divergences across datasets, but validating them would require further research:

Some selection bias in the datasets;

Time differences (TrackVC data is lagging by a quarter);

Differences in the treatment of portfolio valuation across geographies (e.g. the way companies are marked-to-market);

Of course, the quality of the underlying assets, in particular in the Series B/C+ segment: either there are less exuberant follow-on valuations in the EU dataset, follow-on rounds take longer to materialize, or there are fewer absolute occurrences of late-stage rounds.

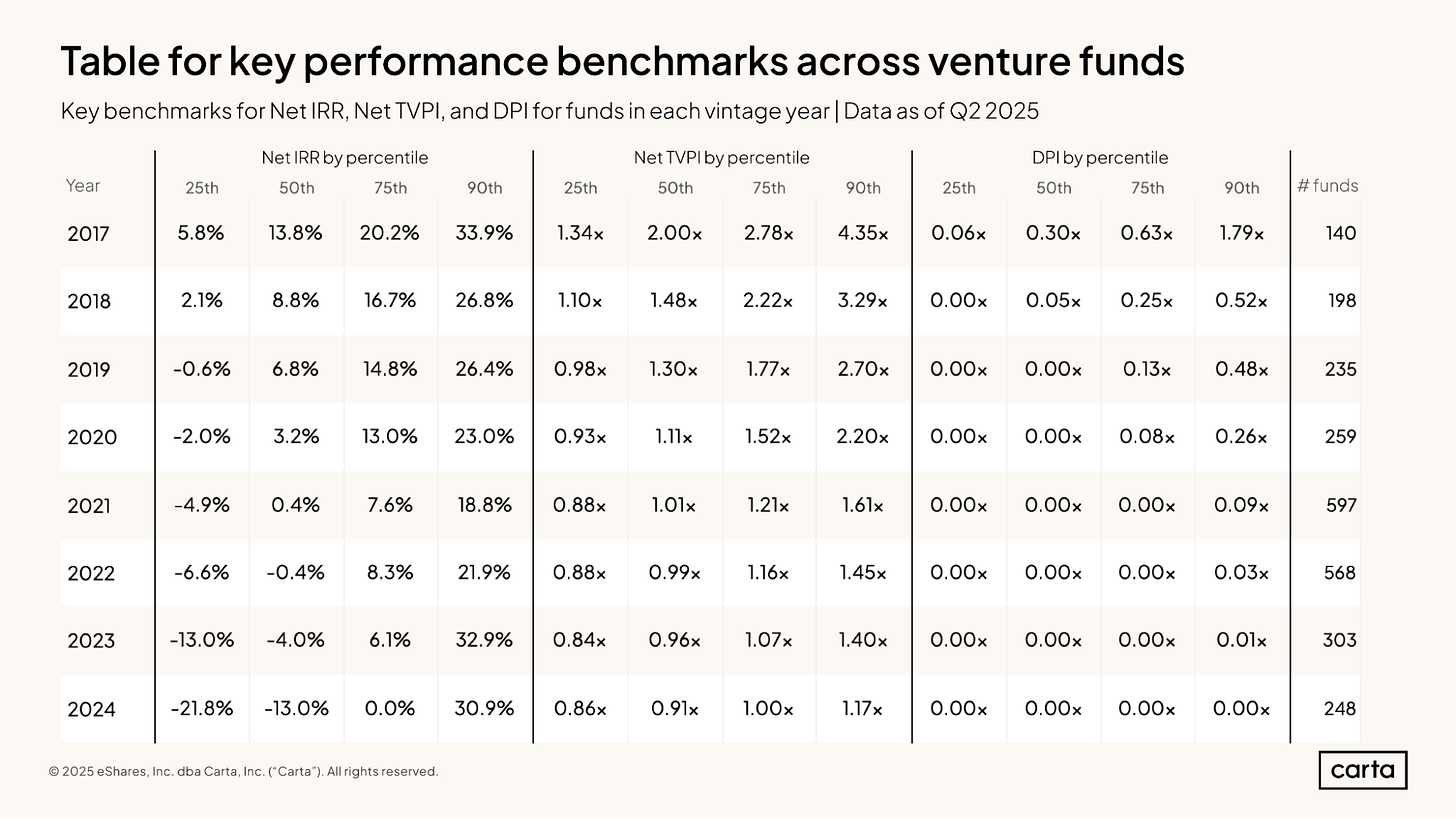

A final note: in the “Reading this week” section above, you can also find the latest Q2 2025 VC fund performance report by Carta. The good folks at Carta prepared a useful comparison chart:

Carta features also the 90th percentile, but in general it looks like their data is directionally similar3 to AngelList.

ITA’s Venture Academy is back

Starting October 1, 2025, Italian Tech Alliance launches the sixth edition of the Venture Academy. Until December 17, participants will attend 12 online sessions held every Wednesday (12:00–14:00 CET), plus 3 in-person special lessons in Turin (Opening), Rome, and Milan (Closing). Applications are open until September 26 EOD via the application form available on this page, where you can also download the full program. The Opening Lesson will be hosted as a side event of Italian Tech Week in Turin and will be free to attend for non-enrolled participants, subject to seat availability (register here).

🌟Jobs in Italian Startups🌟

If you want to share or more job positions relevant to the Italian ecosystem, fill out this form. Looking for a new job? Check out this link!

Latest job positions:

Startup Events in Italy🎪

Keep an eye on the upcoming events in the Italian ecosystem. Feel free to add an event through this form.

Latest events:

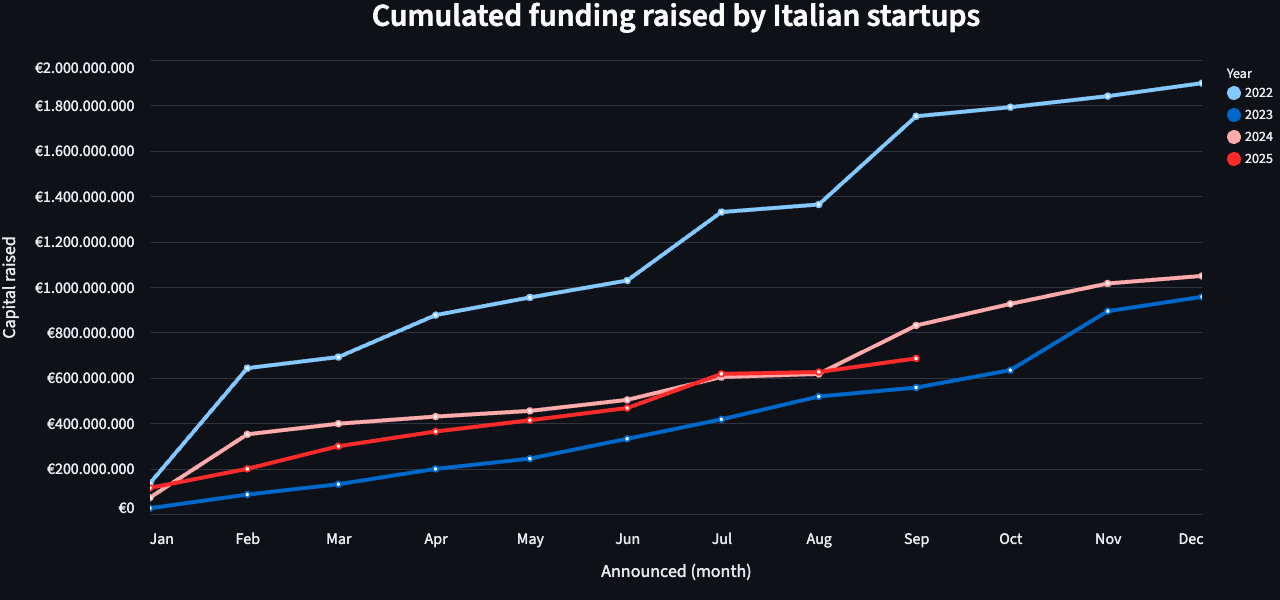

Fundraising Tracker 📈

Ending Notes📝

Don’t forget to check out the TWIS dashboard for the latest updates.

If you want to know more about sponsoring TWIS (and/or the podcast episodes), read some info here and send me a note!

Giacomo Mollo and I comment weekly on the latest news: subscribe to our podcast on YouTube, Spotify, Apple Podcast, Amazon Music, and other platforms to get additional insights on what is happening in the Italian ecosystem.

Have a great week,

N.

Data from TrackVC is up to date as of 30/9/2024, while AngelList is up to date to 31/12/2024, so take the comparison with a grain of salt. Considering the timeframes involved, I expect discrepancies to be limited.

Yes, I am a boomer, I used excel to build the tables.

Carta reports data as of 30/6/2025.